With respect to the Lender regarding The united kingdomt, more than 1 / 2 of mortgages that originated from Q4 away from 2019 had 5-seasons fixed interest levels otherwise longer. For the , the average price having a 5-season repaired mortgage was 2.69%, when you are an enthusiastic SVR had the common speed out of four.41%. That is a huge difference of 1.72%. Hence, extremely homebuyers are susceptible to get repaired-price mortgage loans.

British mortgages fundamentally amortize to have 25 years. Someone else may even capture provided ten years. Already, the most famous fixed-speed label is the 5-12 months option.

Small several-season terminology always incorporate a decreased prices. However they do not bring steady money for a longer period. For folks who remain delivering short, fixed-rate selling, you ought to remortgage more frequently. It is a pricey and time-consuming processes. If financial rates boost immediately after 3 years, you might end up getting a high rate even though you secure a predetermined-rates loan.

Meanwhile, 5 to help you 10-season fixed terms have a bit higher costs than small, fixed terminology. But because the a bonus, you gain longer payment stability, that’s a good trade-of for some homeowners. There is no need in order to remortgage all the 24 months. In the event that prices raise, you may be guaranteed to make same costs within the mortgage label. As well, when the rates of interest ultimately decrease, you cannot make use of lesser mortgage repayments. You have to make a comparable payment during the 5 otherwise 10-12 months name.

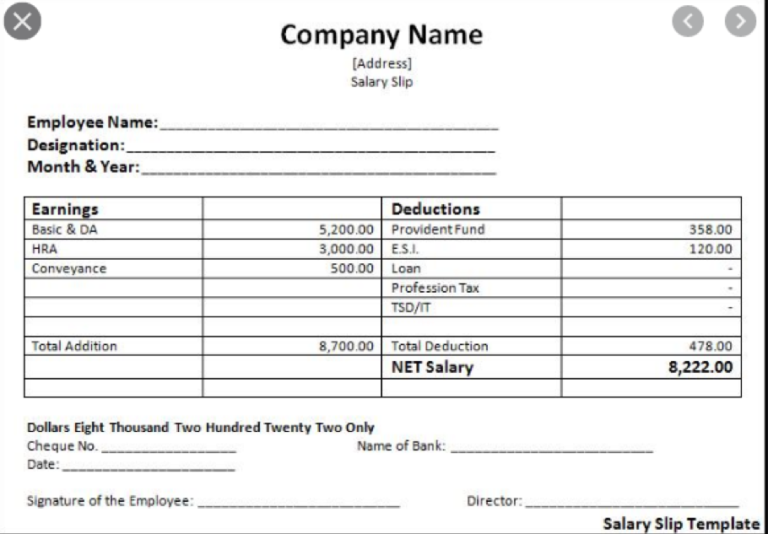

Evaluate home loan costs anywhere between SVR mortgages and various fixed-speed terms and conditions, relate to the fresh new desk below. The following table shows average pricing having United kingdom mortgages by .

The latest desk signifies that the greatest home loan speed ‘s the SVR during the 4.41%. Notice exactly how repaired cost increase because name is actually expanded. The 2-12 months repaired label gets the low rates in the 2.49%, because higher price is the ten-seasons repaired identity during the 2.85%.

Much like the United kingdom, most homeowners in the us plus like fixed-price mortgage loans. The newest foreseeable costs cause them to more desirable alternatives for borrowers. However, in place of British mortgages, fixed-rate mortgage loans in america business are still fixed for your lifetime of the mortgage. That it usually can last for 3 decades. When you find yourself a fixed-home loan in britain can only continue for 2 so you’re able to 10 ages, a predetermined financial in america was secured towards full 30-year bad ceedit loan in Meridianville name. In the event the All of us borrowers must changes their rates and name, they must remortgage its financing, to create refinancing in the us housing market.

At the same time, in britain, youre obliged to remortgage your property loan every couple of many years, based on your favorite name. If you don’t, your mortgage reverts to the an elementary adjustable rate mortgage (SVR) shortly after a predetermined-speed mortgage. This can cause unpredictable repayments one to changes according to the Financial out of The united kingdomt legs speed, while the lender’s speed requirements.

Prior to their repaired home loan changes so you can a keen SVR, you could potentially remortgage towards a new repaired rates identity, otherwise prefer most other home loan choices that helps increase your own savings. Remortgaging lets homeowners to help you secure a minimal speed with a new mortgage name to stop the higher SVR price. This remortgaging procedure is going to be constant because of the debtor up to the leftover harmony is actually paid for the twenty-five-seasons identity.

Comments are closed.