Everything you need to know about mortgage brokers in one place. Use all of our “faq’s” section knowing all about mortgage loans, refinancing, house equity credit lines and much more.

Your mortgage is excellent, however, often you want you had some thing a bit more. Maybe you would like one that’s a little reduced, otherwise the one that had a little bit faster appeal or perhaps it’s not also in regards to the mortgage itself, you just want to cash out the residence’s guarantee. Before you can inform your current financial it is not they, it is you, it is wise to figure out how much you will be charged so you can enter a different financing.

Anyway, the grass actually always eco-friendly on the other hand of that barrier, often it merely will cost you a group right after which will leave your having one during the a Ferrari.

It could feel a little stop-user-friendly to invest people to save a little money, but that is exactly what is when you refinance your own financial. If or not you utilize a streamline home loan refinance, a vintage re-finance or even play with one of those no cost refinances you to definitely definitely will set you back some thing, there are a lot of individuals with working to one another in order that every correct papers get to the best locations to pay for the brand new note. People as well as every anticipate to get paid (jerks!), and those costs pile up.

Even when fees may vary of state to state, the fresh new Government Set aside Board signifies that using 3 to 6 per cent of the matter you’re borrowing from the bank is not out-of-line. You are able to spend a whole lot more if you opt to get your rate off next having factors otherwise try subject to good prepayment punishment having paying your home loan regarding before you can originally assented.

No, refinancing wouldn’t assist folk, but that is why there is certainly a great deal written on the subject. We have all a situation which is slightly different. It might help you much as well as your next-door neighbor nothing at all of the. There are ways to figure out if it’s a great fit, however, basic thing’s very first: what makes you considering an effective refinance?

Hi, it is far from the team, however should probably believe enough time and hard about that. If you’re nonetheless sure we would like to tap your property to have a vacation, consider household equity finance. These are typically a better complement your circumstances and won’t pricing nearly normally.

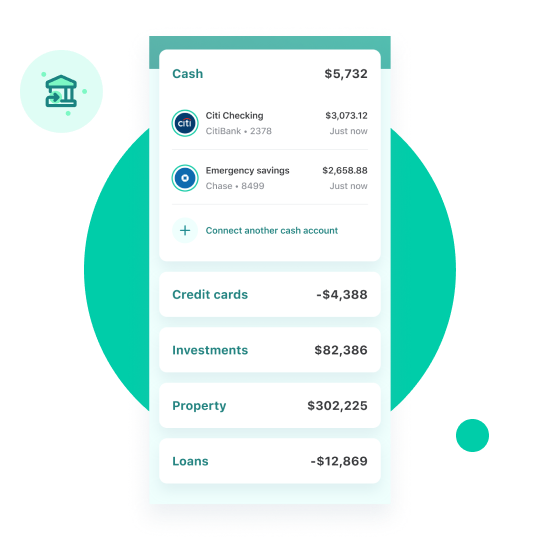

Property guarantee personal line of credit (HELOC) will get suffice your own motives better than refinancing the whole family. It is a form of domestic collateral loan that takes good back seat for the primary financial and you will will act as a card line. You might bring your debit cards toward community do it yourself store and get what you need for every sunday since your upgrade progresses. You don’t have to utilize it at once. Furthermore a lot less expensive upfront much less with it than just a refinance.

Ah, today you happen to be talking refinancing words! If you would like alter your rates, that’s refinancing area. Before deciding towards the an excellent re-finance, in the event, get some Trust Estimates about financial you may be refinancing thanks to. Capable give you an idea of what the complete monetary photo will such adopting the the fresh loan is during set. Home loans commonly something you can examine truly, regrettably. There are a lot of facts from the gamble.

A modification of conditions is a superb cause to re-finance and you will no-one perform fault your to possess attempting to re-finance towards the good fully amortizing, repaired speed notice. In this case, get a few additional Good faith Rates from more banks otherwise toward some other circumstances, dependent on what sort of bank you might be handling (some could offer so much more financing versions than others) and choose one which makes the very sense for your life. No matter what your choice, the likelihood is you are going to save a lot of money.

Same as there are no 100 % free meals, there aren’t any totally free home loan refinances. All these folks from way up around the beginning of which page nevertheless need to get reduced. What the results are during the a no cost refinance is you however afford the fees, they truly are simply not paid out regarding pocket. You either outlay cash in the form of additional attention more the life span of the loan, or you outlay cash if bank wraps them into the the brand new principal, you buy to expend attention on it into remainder of your loan.

But that is not saying they aren’t helpful factors, as the often these are generally your best option. Just like often having pizza pie together with your colleagues is the greatest option, even if you learn it’s going to make you indigestion, because your works offered it and you did not have to spend for it.

Comments are closed.