Contained in this publication: An overview of the most FHA mortgage quantity to possess 2024, having a conclusion out-of how they may apply to your due to the fact a beneficial house client and you will debtor.

The FHA mortgage program allows eligible borrowers buying a home that have a deposit as little as 3.5%. This method has the benefit of far more versatile qualification criteria, when comparing to old-fashioned / regular mortgage.

However, there is an optimum number you can borrow while using the an enthusiastic FHA loan to acquire a property, and they caps are commonly referred to as FHA loan restrictions.

During the 2024, the maximum mortgage quantity for an individual-house start from $498,257 to help you $step one,149,825. It will vary according to the county where in fact the house are bought is.

The individuals certainly are the official limit for individuals, according to the Federal Houses Administration. But your mortgage lender might consider your revenue and you can obligations problem, to decide just how much you can acquire having an FHA loan.

The bottom line: Not everyone can use the most FHA loan amount for their specific condition. Individuals should have adequate earnings to handle the monthly premiums, towards the top of almost every other repeating costs.

The utmost FHA financing size may differ from the condition, because it’s partly based on median home values (that also will vary of the location). Areas having high home values tend to have higher financing limits, and vice versa.

But just like the a house client, you truly only have to be aware of the limitation FHA mortgage proportions into the particular condition where you intend to pick. This new nationwide assortment mentioned above is not very beneficial. Thus let’s get regional…

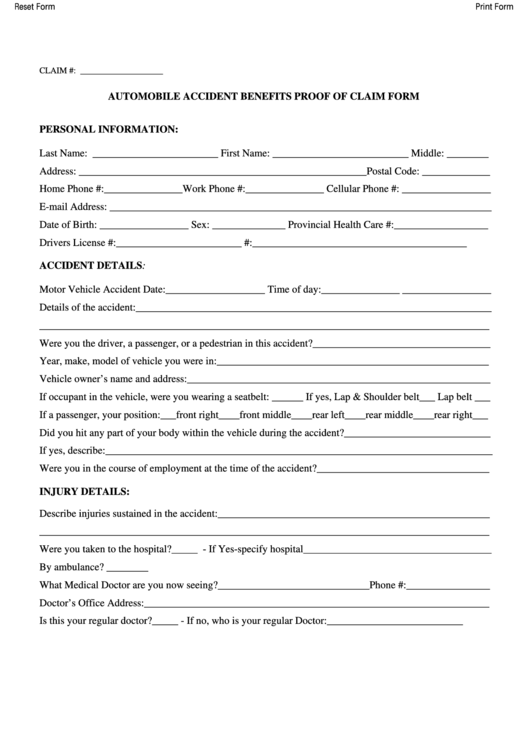

Immediately following finishing such measures, you will be offered a page you to is comparable to the brand new screenshot example lower than. (You can click so you can enlarge it.)

This case shows the 2024 FHA mortgage restrictions to own ily column relates to regular unmarried-household members belongings. The latest two-family column shows the new restriction to possess duplex design properties, and the like.

Maximum FHA loan numbers restrict how much you can borrow when using an enthusiastic FHA financing purchasing property. Whether your possessions you want to get is higher than the fresh new HUD-implemented maximum to suit your state, you’ll want to generate more substantial down-payment to cover difference.

Alternately, you could use a conventional financing to invest in your purchase, since the individuals circumstances normally have large limits when compared to https://paydayloancolorado.net/mountain-meadows/ the FHA system.

In the higher-pricing areas for example San francisco, Ca and you will Arizona, D.C., an FHA-covered real estate loan you are going to restrict a home consumer’s possessions options. This type of finance are reduced commonly used in the pricier construction markets, as well as for one most cause.

Individuals who would like to purchase a property you to definitely exceeds the utmost FHA loan amount due to their town may have to (A) mention alternative resource choices otherwise (B) developed more substantial advance payment to purchase change.

Particularly, the new median house price in the county regarding Tx is now as much as $305,000. This new FHA mortgage restrictions for this county may include $498,257 (in the most common areas) as much as $571,550 (regarding Austin town).

Therefore property visitors when you look at the Tx should be able to fund an average-listed assets in the place of bumping for the maximum FHA loan amount to have their condition.

If for example the median otherwise average income price close by was beneath the FHA loan limitation, you shouldn’t have trouble funding property in that system.

At exactly the same time, if you learn you to definitely regional home values are a lot more than the utmost FHA mortgage proportions to suit your urban area, using one to program you will limit your casing solutions.

In the course of time, you have got to use the financial product which works best centered on the types of finances and home-buying requires.

Very, in which perform this type of FHA mortgage limits are from, and just how will they be computed? Based on a beneficial HUD pr release you to definitely announced the present day maximum amounts:

FHA required of the Federal Construction Work (NHA) … to set Solitary Family submit real estate loan limits in the 115 percent regarding urban area median house prices for a specific legislation, susceptible to a specified floor and a threshold. According to the NHA, FHA works out give financial limitations by the MSA and state.

From the significantly more than quote, MSA stands for metropolitan statistical urban area. The fresh new FHA computes the maximum FHA mortgage quantity because of the urban urban area and you can condition. Therefore, the restrictions are often an equivalent round the a complete urban area area, even when one urban area has 3 or 4 counties.

It’s also wise to be aware that maximum FHA loan proportions normally go from 1 year to the next. They generally to alter up to keep up with rising home values.

HUD declares these types of change at the end of annually, once they publish the fresh new limitations into next year.

Brand new FHA loan restrictions listed above portray the maximum amount a beneficial person is borrow, according to the Agency off Casing and Urban Invention (HUD).

However, HUD will not feedback your financial situation to decide how much you should use acquire. The borrowed funds lender that do one. Very at some point, this is the bank one to decides your own restrict loan dimensions.

Definition: The debt-to-money (DTI) ratio measures up their month-to-month loans costs towards the gross monthly money. Loan providers basically favor a good DTI less than a specific endurance, generally speaking around 43% to fifty%.

The fresh joint DTI proportion includes all repeating debt obligations, eg car and truck loans, student loans, playing cards therefore the monthly homeloan payment. A lowered DTI ratio suggests that a debtor try less leveraged that can be able to manage most obligations.

The debt-to-earnings ratio (DTI) is their monthly debt costs divided by the terrible monthly income. It number is a sure way loan providers level your capability to manage the fresh monthly premiums to repay the bucks you intend to help you borrow. More mortgage services lenders will receive various other DTI limits.

This is probably one of the most very important checkpoints utilized by home loan loan providers to decide their restriction loan amount. You to applies to FHA and you may antique mortgages including.

Worth understanding: The Government Homes Government limitations extremely individuals to help you a max debt-to-earnings proportion regarding 43%. However, you’ll find conditions to that particular general.

Comments are closed.