New wedding from home loan company inside the thus-titled sub-finest financing or financing so you can consumers which have bad credit otherwise decreased dollars or earnings keeps started a boost in home ownership certainly one of lower income and minority properties. It has also, although not, contributed to abusive financing practices also known as predatory lending. As a result, of a lot claims and you will municipalities keeps enacted laws and regulations one outlaw means working by predators. Jack Guttentag, an emeritus teacher from funds at the Wharton, indicates a solution which he states manage benefit the complete markets.

From the 1990’s, mortgage brokers located a means to provide productively in order to customers who before cannot be considered due to poor credit, or insufficient dollars or earnings. This was given birth to titled sub-prime lending. Because the development of sandwich-best lending stimulated an excellent ong straight down-money and especially fraction house, they got a significant disadvantage. Some borrowers began to be victimized by the abusive financing techniques, with become known as predatory lending.

Predatory lending can take variations. In some instances, lenders get remind refinancing to create charges however with zero benefit into the borrower; in other people, they may propose money you to a borrower you should never possibly pay, hence causing loss of our home. Unscrupulous loan providers may type an enthusiastic undisclosed prepayment penalty or similar provision for the loan, charge too-much fees otherwise points and you can lead individuals so you can financial sizes one to carry high fees.

In reaction on the introduction out-of predatory credit, of several says and you may municipalities payday loan Gleneagle keeps introduced or are actively given regulations you to definitely outlaws strategies utilized by predators. Inside a papers named, Another Look at Predatory Lending, Jack Guttentag , a fund emeritus teacher from the Wharton, points out that these methods enjoys genuine uses, and prohibiting them to curb predatory financing minimizes borrowing availableness so you’re able to the folks the newest guidelines is designed to assist. Guttentag indicates an alternative remedy that does not remove borrowing from the bank and you may who would work for the whole business not simply this new sandwich-perfect sector.

The top cause for predatory credit is the reasonable traps so you’re able to energetic shopping of the even advanced level borrowers. One to burden is specific niche rates. Few consumers just remember that , financial prices are impacted by many variables amongst the debtor, the house or property, the transaction together with paperwork. Costs that will be totally modified for the information on a bargain are transaction particular. The prices cited on the push or higher the telephone is common, for example he could be centered on a set of standard presumptions that can otherwise may not affect a certain consumer.

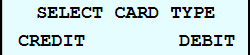

At exactly the same time, the price is multiple-dimensional, such as the interest rate, upfront fees indicated since the a percentage of mortgage (points) and you will initial charge shown inside cash. Additionally, loan providers usually give various interest/point combinations from which individuals can decide, also combos with a high rates and you may bad affairs otherwise rebates. Rebates are often used to hide out of shoppers simply how much home loan brokers build with the purchases.

The mortgage market is and additionally unstable, which have pricing switching apparently and without warning. Extremely mortgage brokers reset costs each morning and frequently transform them during the day. Consequently buyers need generate all their comparisons on the exact same date to own comparability, plus this could not really works if the pricing change in big date.

Likewise, procedure delays is invalidate a great shopper’s perform. A borrower get truthfully pick a knowledgeable contract for the certain go out, although chosen bank does not protect the purchase price until new borrower has actually submitted an application. That is certainly many days later on, at which part this new chosen financial might no expanded feel providing a knowledgeable deal. For the an equivalent vein, loan providers cannot guarantee closing costs up to right before the fresh closure date, of which area brand new debtor keeps nothing power in case the bank finds out a different sort of cost.

Consumers purchased multiple techniques for conquering some of the issues in seeking a mortgage. You’re to submit software to two (or more) loan providers, making it possible for the price so you’re able to float up until all the was approved and you will after that trying to find on the top lock rates. But not, pair borrowers go so it station since it is time-consuming and risky. In the event your lenders take a visit, this new debtor could possibly get clean out both purchases.

The web brings purchase-specific rates quotes out of multiple financial institutions on a single date, that is a major aid in hunting. Very consumers, but not, require an individual to help book them from procedure. Although prospective consumers browse the web to own suggestions, less than dos% interact around.

To settle the situation out of predatory credit in the home mortgage sector, Guttentag supporters flipping financial hunting off to lenders becoming the latest agents away from borrowers.

Mortgage brokers can be store lenders a whole lot more effortlessly than consumers since brokers are in the marketplace every single day and you will understand the markets niches. Their relationships which have several loan providers put them to obtain men and women promoting sort of possess. They understand from which lenders can also be perform quickly and which take more time but could bring compensating benefits. And since loan providers be aware that agents are knowledgeable consumers, price differences when considering lenders try less on general sector than simply in the shopping market.

Guttentag shows one to home loans have to establish the percentage in writing just before entry a software to a lender; so you’re able to credit from the fee people settlement received out-of loan providers; to take and pass toward individuals wholesale costs off lenders; and also to promote for the individuals written confirmation off rate hair gotten on bank.

Guttentag keeps prepared a voluntary organization from mortgage brokers, that he calls Initial Lenders, or UMBs, with then followed these types of values. If you’re old-fashioned home loans mark up the fresh new undisclosed pricing it discover out-of lenders, UMBs transit the newest general rates quoted because of the lenders and you will charge borrowers a discussed fee for their qualities that’s stipulated upfront. Any charge paid off towards the broker by businesses employed in the transaction is credited on the borrower. This new representative acts as brand new borrower’s broker in selecting the loan sorts of and features you to best meet with the user’s demands as well as in choosing the reasonable wholesale speed.

Comments are closed.