Lending swimming pools and you may syndicates present unique opportunities in which a collective group out of dealers pools investment to pay for tough money finance which can end up in high money prospective on account of a more impressive capitalization pricing and you can diversification of opportunities. These organizations usually costs an assistance commission for managing the mortgage and make certain the hobbies is actually safe due to strict lien terms and you can total insurance policies. Because of the spread chance around the numerous investors, lending swimming pools and you can syndicates offer a persuasive blend of shelter and you will earnings regarding difficult money financing industry.

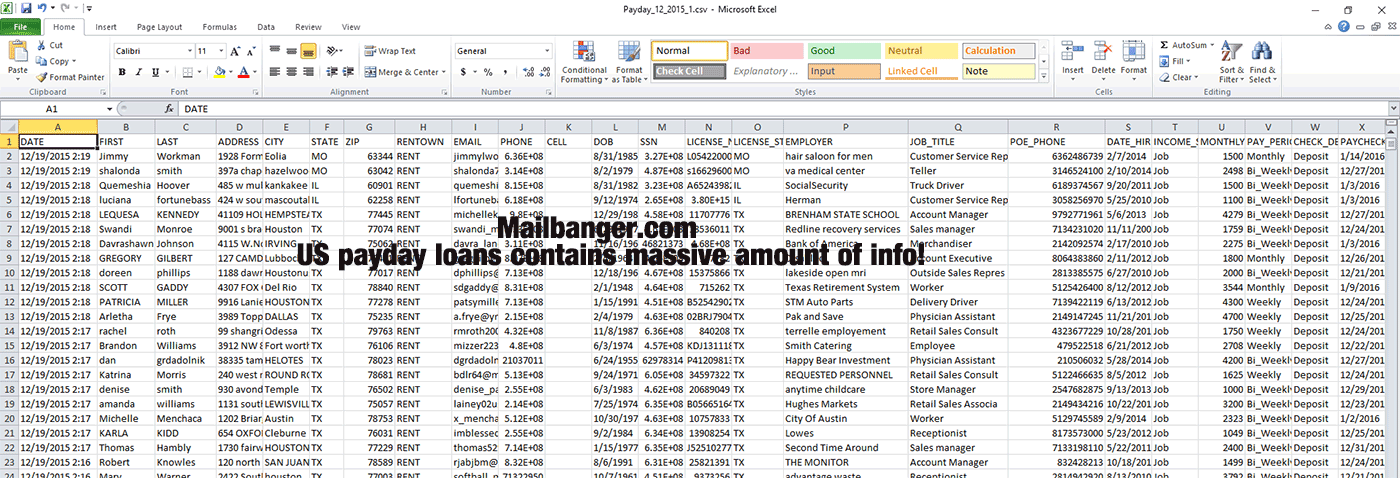

This kind of bank in an arduous money financing is also significantly affect the financing terms, commonly dictating interest levels, repayment schedules, while the standard of independency considering. Private dealers may offer a customized approach, financing credence in order to a keen applicant’s profile and you will endeavor stability, that’ll produce more negotiable words. On the other hand, professional credit providers might provide structured mortgage servicing that have stringent criteria however, deeper money having full projects eg relocation otherwise large-level renovations. Crowdfunding provide you are going to encompass varied terminology because of the cumulative characteristics of South Carolina loans one’s resource, while you are organizations eg pay day loan features are often smaller beneficial due so you’re able to large-interest levels and you can smaller financing conditions, designed for immediate, short-title financial requires.

In advance of delving to your a difficult money loan, its important one people rigorously consider rates or any other related will cost you so that the economic practicality of one’s venture. Tests regarding financing-to-value rates and you may equity products is built-in to help you choosing the new guarantee adequacy with the an asset, should it be home-based otherwise commercial. Additionally it is important to weigh the potential risks and you will proper positives of those funds, close to thorough said of courtroom and you may regulatory factors. New forthcoming areas usually elucidate these types of vital points, anchoring the choice-and come up with processes into the strict usefulness and told perception.

When it comes to what’s a painful currency mortgage, possible individuals must study brand new associated interest levels and you can costs, including the origination payment. These financing, if you find yourself obtainable and flexible, will bring high interest levels versus conventional credit or company loan alternatives, highlighting the greater number of exposure and you will expedited provider provided by the lenders. Exploring these types of monetary elements meticulously can protect a trader out-of undue burdens and you may line up its funding means with an obvious understanding of the costs employed in protecting a challenging money mortgage.

Assessing the borrowed funds-to-value (LTV) ratios and guarantee requirements are a standard step to possess individuals in order to learn when engaging which have difficult money lenders. LTV, an important determinant out of exposure to own lenders, quantifies the loan count as a share of one’s property’s worthy of, at the rear of loan providers inside the ascertaining simply how much flow needs as sureity against the new loan’s attention and you will dominating. Understanding of that it proportion, next to a robust comparison of security, equips consumers that have a sensible opinion with the feasibility regarding a beneficial tough currency financing, guaranteeing they have enough collateral to meet the latest lender’s terms and you will protecting facing more-control.

Before protecting a painful currency financing, investors need certainly to cautiously equilibrium perils up against advantages. Entertaining an attorney having homework can be mitigate courtroom dangers, while an extensive data of the loan’s price, along with effect on downpayment and you may budget, guarantees economic feasibility. Anyone is always to take a look at just how a painful currency financing suits within larger economic method, given the bank account and money supplies. Well-advised borrowers can also be power such money on the advantage, protecting punctual money that aligns making use of their resource goals and you will exposure tolerance.

With regards to difficult money loans, it is important to own traders in order to comprehend the new court and regulating architecture one regulate such monetary products. Guidelines one to dictate the fresh new terms of financial obligation issuance, particularly in home, may vary extensively from the part and you will connect with both loan providers and consumers, along with borrowing from the bank unions or other financial entities. Careful said ones factors will not only help be certain that compliance having appropriate guidelines plus strengthen the security of your dollars spent. Information these types of rules very carefully can prevent future legal difficulty, promoting a more secure and fruitful financial support trip.

Comments are closed.