Securing financing with lower local rental assets rates might be simple enough. Follow this action-by-action help guide to comprehend the being qualified procedure and exactly how newest financial prices to have money spent could affect their credit costs.

When selecting a rental possessions, you have access to a few of the exact same money choices given that might for a first quarters or one minute mortgage loan. However, dealers provides several option financial loans to take on.

For every single bank deliver other money spent installment loans online South Dakota mortgage rates, very evaluate various proposes to ensure you get the best deal offered.

As compared to mortgages to possess no. 1 homes, investment property money provides their group of benefits and drawbacks. Here is a list of a number of the main professionals and disadvantages.

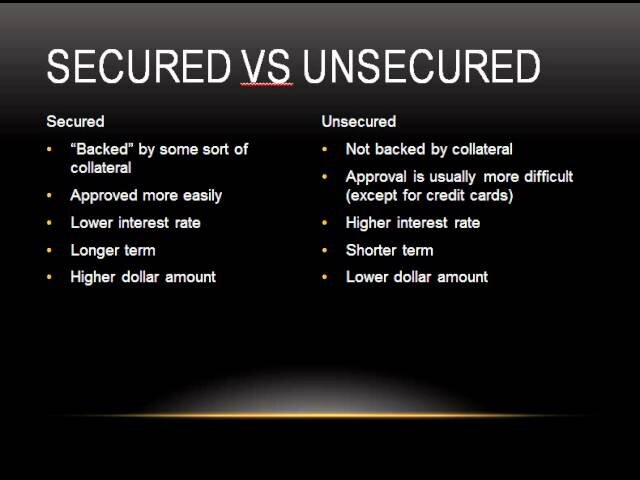

Investment property financing fundamentally have higher mortgage rates of interest than antique financing for primary houses considering the improved exposure to have loan providers.

Concurrently, home loan prices on the money spent usually were added charge otherwise rates nature hikes to take into account the possibility of openings. However, old-fashioned fund promote down rates and easy terms and conditions, particularly for basic-big date home buyers or manager-occupied properties.

Sure, home loan pricing have been high for money properties. Money spent financial prices to have a single-house are about 0.50 in order to 0.75 % higher than proprietor-filled house mortgage rates. If you find yourself to acquire a two-4 unit strengthening, assume the lending company in order to tack at least a different sort of 0.125 in order to 0.25 percent onto your interest.

Sure, 30-12 months mortgage loans are typical to have capital qualities. Whenever you are faster terminology eg 10, fifteen, otherwise 20 years are available, a 30-year real estate loan offers straight down monthly obligations. However, 30-12 months interest levels getting investment property are usually highest, leading to a great deal more appeal repaid over the years.

Even if you could be eligible for a home loan to your a keen investment property utilizes your financial portfolio. You will want a credit score with a minimum of 640, however probably need the rating significantly more than 700 so you can qualify for a lesser interest rate. You will need a down payment of at least 15 so you’re able to 20% and you can significant dollars supplies.

Minimal down-payment to have a 1-product money spent is actually fifteen percent to own traditional money. not, it can incorporate financial insurance coverage and better rates. Make a 20% downpayment to carry off costs. To have a 2-cuatro product home, minimal advance payment try 25 percent. If you find yourself to acquire dos-cuatro units and certainly will are now living in among them, you can make use of an FHA financing which have as low as step 3.5 percent off.

Comments are closed.